Discover how a major US IT manufacturer selected Virtual Trader to automate and regulate intercompany processes across a complex ERP and SCM landscape

It’s no surprise that operating a multinational with a global manufacturing setup and customer base can create complex intercompany challenges. Couple that with running multiple systems for finance and supply chain and you’re looking at a situation that quickly stretches the capabilities of standard ERP systems.

We consider here how one customer used Virtual Trader to centralize and standardize its intercompany accounting process, allowing it to operate a true shared service, drive a faster period close, and free-up valuable working capital.

Our customer is a US-based, global IT manufacturer with a business model that spans hardware, software, and services. From a financial accounting perspective, this results in intercompany activity from a wide variety of sources across many different countries and legal entities.

The company operates a complex architecture of applications controlling order management (OM) and supply chain management (SCM) and wanted a centralized solution for controlling intercompany accounting and compliance at the transaction level.

M&A activity had also resulted in the use of multiple ERP systems for GL and financials, complicating the financial accounting and reporting process. This meant that intercompany was disparate and difficult to reconcile across systems, leading to inaccuracies and delays in the close process.

The aim was to gain control of the accuracy of intercompany activity across the enterprise through an automated process without having to introduce costly and inflexible customized solutions.

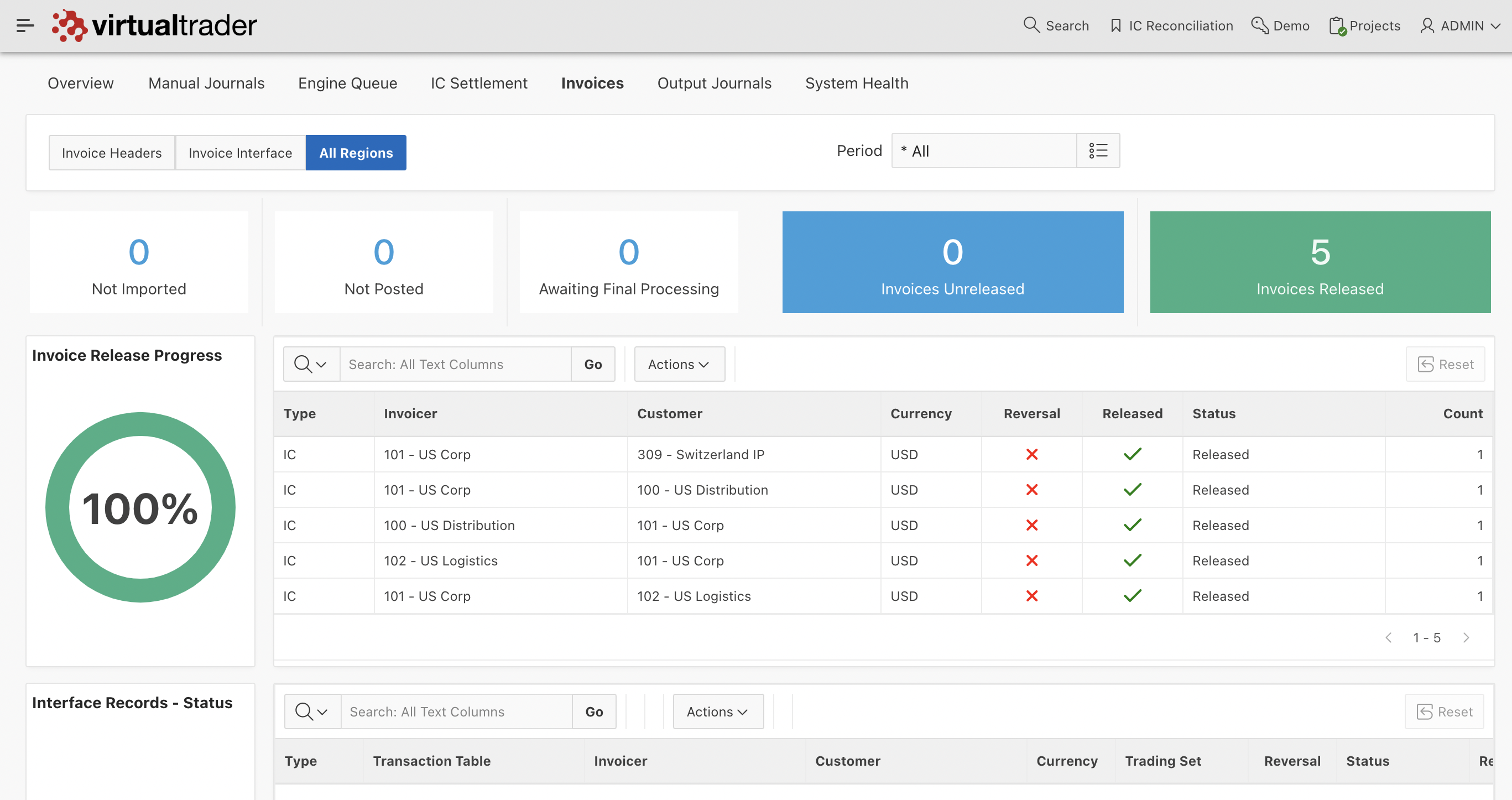

The solution was to deploy a range of Virtual Trader modules to address challenges at each stage of the IC lifecycle: create, reconcile, and settle.

The VT intercompany engine was deployed to automate the creation of multi-tier IC accounting, audit records, and regulatory compliance documents using business events issued by the myriad OM & SCM systems.

To complement this, the VT Manual Journal Entry (MJE) module provided a single entry point for cross-company charges across the enterprise.

All IC activity — whether initiated automatically, manually, or remotely outside of VT — was interfaced to the VT intercompany subledger (ICS) module for tracking, aging, and automated settlement. Integrations to treasury management systems allowed for full automation of IC accounting entries at the time of settlement.

Where IC was created in siloed ERP systems and with a timing offset between IC AR and AP invoicing, the VT IC Reconciliation (ICR) module was implemented to provide visibility into unreconciled items, thereby allowing the business team to quickly address and rectify the root cause.

Automate intercompany end to end

Provide a single view of the world to support shared service center operation

Drive timely intercompany settlement to improve working capital

Close books quicker at period end

We offer a no-cost demonstration of Virtual Trader so you can experience its powerful palette of features!

US

+1 800 961 9640

US

+1 800 961 9640

Europe

+44 2476 236 990

Europe

+44 2476 236 990

Copyright © Virtual Trader